This tax season is officially done as of today! Well, okay, I guess you could say it still has until October 15, but we’ll focus on today’s deadline instead.

Perhaps the biggest thing that baffles me through tax season is the constant question, “What can I do to pay less in taxes?” The easy answer? Make less money. But no one really wants to hear THAT, right? Ultimately, the answer is complicated and with all things tax related, it is an individual case basis.

I repeat. Everything is a case-by-case basis. Just because Bob did x and didn’t owe money doesn’t mean doing x netted the same for Jane.

Every. Single. Return. Is. Different.

But. A few simple ideas to save on paying taxes…

– You can have more deductions, which, if you think about it, it means spending more of your money. (Wait… I thought I was trying to save money.)

– You can have less being paid to you without taxes being taken out before its even given to you. As in, get paid by W-2 instead of 1099. Though, you do realize, you’re still paying taxes. Its just not in the form of a check when you file your return.

– How about I just don’t report this income? Okay. Well, you better not try to show that income to buy a house or a car or whatever, because that’ll throw up a nice red flag when the numbers you filed and the numbers you gave on the application don’t match. And God forbid the person who paid you that money gets audited… because chances are they’ll paper trail it right back to you. At that point? Well, at that point they find out and you owe penalty, interest, and you’ve gotten the headache of an audit. Do people get away with not reporting income? Sure. Would I recommend trying that? Never.

– You can just make less money. But, frankly, I’d rather make $100, pay out $20 and still have $80. Instead of making $50, paying out $10, and still having only $40. Yup, I really stuck it to the government there. I also screwed myself.

Ultimately, taxes are a fact of life. And as much as I am sure people grumble that their tax dollars are helping fund that deadbeat down the street who lives on unemployment… realize its tax dollars that also fund keeping our road systems going, pay for emergency personnel, and help individuals after tragedies like tornadoes, hurricanes, mass fires, etc.

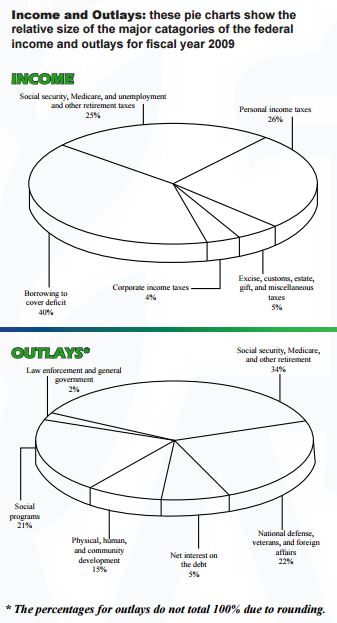

I am blatantly stealing this from IRS Publication “Why Do I Have to Pay Taxes?”

Oh yeah. Tax dollars also help pay for our military. Â There’s that little fun fact, too.

So any time I hear someone say, “How can I pay less taxes?” it, frankly, burns me. You made money. Chances are, you made GOOD money. Pay your taxes and move on… you’ll spend more money and time trying to avoid paying taxes than you would if you just paid it and went on…

This tax season has been rough, with a good portion of that stress due to the Healthcare Act. Here. Let me just be blunt on this. This is MY PERSONAL OPINION and does not reflect on anyone but me.

I think the healthcare act, at heart, is good. But I disagree with forcing Americans to have insurance. I think its a serious over reaching of the government to mandate that. Beyond that, I think its absolutely ridiculous to have the IRS regulate this. Its made the tax code and tax filing 8000% more stressful. And that is, in my opinion, stupid.

So. There you have it. I said it. Healthcare Act, fine. Making it a law to have insurance, though, is bullsh–.

But, here we are. April 15th. We did it. We survived. Still a lot of returns to be filed, but those all have extensions filed. It feels good to get here… time to start the next phase of 2015